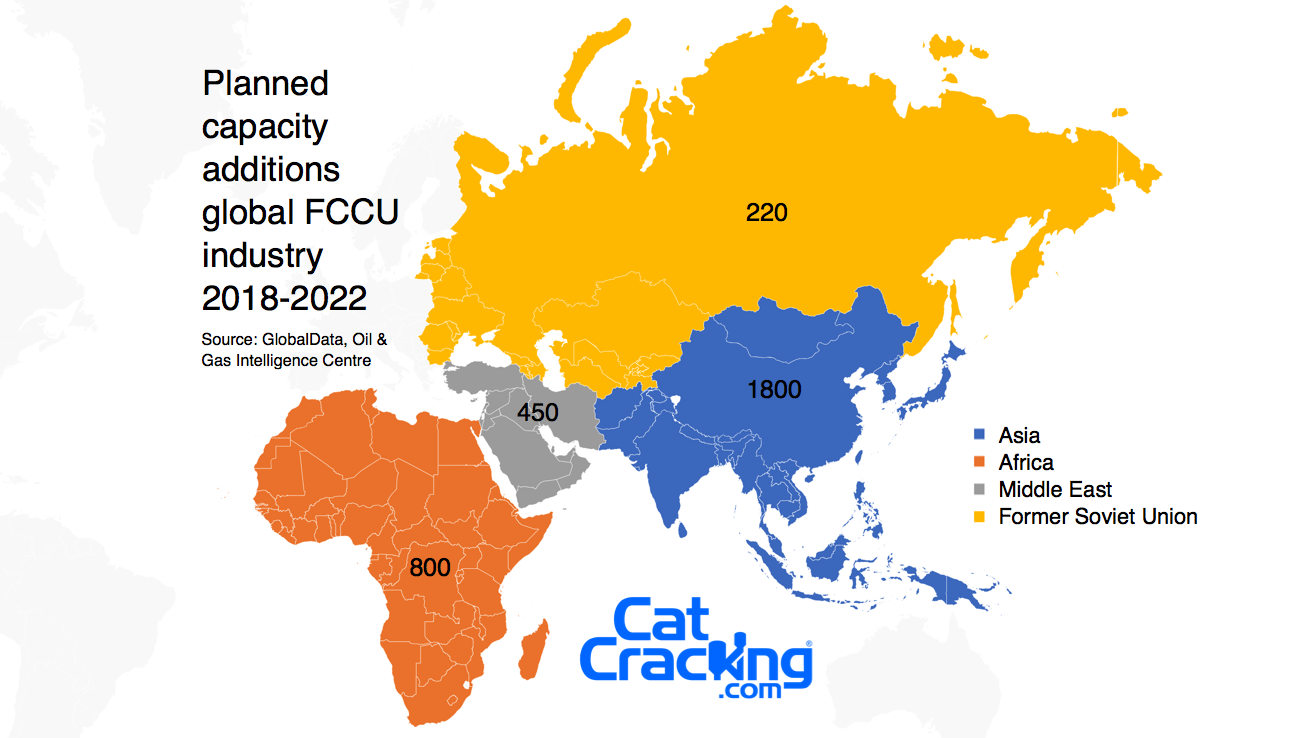

Increasing demand for gasoline, olefinic gases, and petroleum products is led by China, India, Cambodia, Laos, Mongolia and Indonesia to meet growing fuel and power needs. Asia is expected to account for 54% of global refinery Fluid Catalytic Cracking Unit capacity by 2022. China alone is planning to add eight FCCUs.

Low labor costs and inexpensive raw material supply has led to a shift in manufacturing from Western countries to the Asia Pacific which complements FCC demand. High consumption of petroleum-based products owing to wide availability and low costs will increase product demand. Increasing backward integration of FCC manufacturers in order to reduce overall ownership costs is also expected to provide several growth opportunities over the forecast period.

Africa will add approximately 800 thousand barrels per day (mbd) of FCCU capacity. Nigeria leads the way with 462 mbd capacity additions.

The Middle East and Former Soviet Union countries are next with planned FCCU production. In Europe and North America FCC growth is negatively impacted by gradual decline in gasoline demand.

Largest planned and announced capacity FCCU’s are Dayushan Island refinery in China 304 mbd, Lagos I refinery in Nigeria at 247 mbd and Pulau Muara Besar refinery in Brunei with 172 mbd.

Key players in the global FCC market include BASF, Albemarle, and Grace. Technology licensors include Technip, Flour, Shell Global, UOP, Exxonmobil, Chevron Lummus Global, CB&I Company, KBR and Axens.

Information is based on GlobalData’s report: Global Refinery Fluid Catalytic Cracking Units (FCCU) Outlook to 2022 – Capacity and Capital Expenditure Forecasts with Details of All Operating and Planned Fluid Catalytic Cracking Units and Grandview Research report: Grandview Research Fluid Catalytic Cracking (FCC) Market Research Report.

Leave a Reply

You must be logged in to post a comment.